Best Critical Illness Insurance

Protecting your family from critical illnesses requires the right coverage. In Arizona, where cancer incidence is high, it is crucial to select the best critical illness insurance policy—whether group, standalone, or with early-stage benefits. At Sweet’s Insurance Solution in Mesa, AZ, we compare options from top companies like Aflac to find affordable fits. This post covers group critical illness insurance, best coverage, Aflac specifics, standalone vs. riders, family plans, cancer focus, and early-stage insurance for 2025.

Understanding Critical Illness Insurance Policies

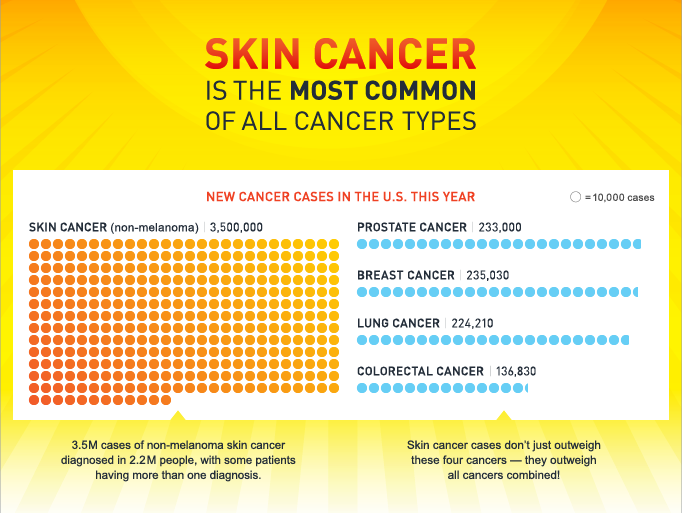

A critical illness insurance policy pays lump sums for diagnoses like heart attack or cancer, usable for any expenses. Family plans extend to spouses/children at 50% coverage. Arizona’s cancer control plan notes higher melanoma rates.

Group Critical Illness Insurance for Employers

Group plans, offered through work, provide employer-subsidized coverage with lump sums up to $50,000. Benefits include lower premiums and no underwriting. Securian Financial notes that it aids financial preparation. Arizona is ideal for small businesses, with tax advantages.

Best Critical Illness Cover and Companies

Top companies include Aflac, MetLife, Guardian—rated high for payouts (92%+). Assurity offers streamlined coverage. Compare via complaint indexes from NAIC.

Aflac Critical Illness Insurance Review

Aflac provides up to $25,000 payouts, with increasing benefits. Reviews praise fast claims but note pathology requirements (Reddit). Affordable, with wellness benefits; covers cancer broadly.

Standalone Critical Illness Cover vs. Riders

Standalone offers full flexibility, covering more conditions; riders are cheaper add-ons to life insurance, but are limited. PolicyAdvisor notes that standalone suits carry a higher risk. In Arizona, a standalone allows switching providers.

Critical Illness Insurance for Family and Cancer Focus

Family plans cover dependents affordably. Cancer-specific riders pay for diagnoses; Arizona’s 40% higher melanoma (University of Arizona) makes this key. Benefits average $150,000 for treatments (CDC).

Early Stage Critical Illness Insurance Benefits

The early stage covers partial payouts (10-25%) for initial diagnoses, aiding early intervention. Munich Re discusses partial benefits. Enhances recovery, especially for cancer.

Choosing the Best for Your Arizona Family

To choose the best critical illness insurance for your Arizona family, start by assessing personal and familial health risks, such as hereditary conditions or lifestyle factors like sun exposure in the desert climate. Consider your budget—premiums range from $20-60 monthly for $50,000 coverage—and evaluate needs like dependent inclusion or early-stage benefits for proactive care. Compare quotes from multiple providers using tools from the NAIC to ensure transparency and value.

In 2025, new trends include using digital tools to speed up approvals, adding more health conditions related to post-COVID issues, and using AI to create personalized Arizona-specific factors, like higher melanoma incidences (28.9 per 100,000 vs. national 22.5, per CDC data), prioritize cancer-focused plans. For small business owners, group options offer tax deductions and employee retention perks. Always review policy exclusions, payout structures, and renewal terms annually, especially during life changes like marriage or relocation. Consulting independent agents like us at Sweet’s ensures unbiased recommendations that maximize protection without overspending.

For More Information

See our pillar “Understanding Life Insurance and Critical Illness Coverage” or “Benefits of Adding Critical Illness Riders.“

Conclusion

The best critical illness insurance safeguards Arizona families. Contact Sweet’s at 480-636-6106, Sweetsinsurancesolution@gmail.com, or visit Mesa office.